The retail sector is undergoing a massive shift, with data and technology as major growth drivers. Today’s business leaders are more open to adopting technology to make data-driven decisions, strengthen their businesses, and enhance analytics capabilities.

Location technology empowers brick and mortar store owners as well as e-commerce retailers to get a complete understanding of the consumer journey, connecting both online and offline touchpoints for optimization and budget allocations. Closed loop attribution enables marketers to gain a holistic, full-funnel understanding of the impact of their media, based on all the key performance indicators (KPIs) that matter to them, irrespective of whether they are related to in-store conversion.

For example, this technology enables retailers to measure behaviors like click-and-collect and BOPIS (buy online, pick up in-store), or make an online purchase on being exposed to the billboard. Retailers and restaurant owners use location intelligence (LI) extensively to stay on top of their game.

In a recent study by 451 Research, one data science executive working for a retailer stated: “LI means everything for the company. It’s very important to keep the doors open for our business.” In fact, 74% of commercial real estate executives view location technology as a highly strategic investment that drives competitive differentiation, and 77% agree that using LI for site selection is highly important to maintain their competitive advantage.

LI can help retail businesses in multiple ways (See Figure. 1). It provides demographic information and ensures store location is accessible to/by a certain target demographic. Through the idea of routing, it can calculate how far most customers are willing to travel to visit a store and the impact this has on store performance, which, in turn, impacts the investment decisions on where to target and advertise.

“Location technology has a huge benefit for all businesses with physical touchpoints to their target audience. We see a lot of value in particular with retailers, restaurateurs, gyms, and health and beauty service providers, as well as shared mobility operators and delivery services,” says Henning Hollburg, Founder and CEO of Targomo.

Hollburg points out three ways how restaurateurs use LI: first, by checking whether a location is suitable for a particular restaurant concept when opening a new restaurant or planning an expansion; second, by checking which restaurant concept is suitable for a particular location; and third by predicting relevant KPIs such as sales or number of visitors. “For restaurants and their offerings, for example, the surroundings are very important. Is it a classic shopping street, a nightlife district or an office area? Here we draw many insights from points of interest and competitors,” he adds.

Movement data, which provides up-to date insights about where the most foot traffic is traced, is very insightful for estimating demand at a particular location. For other businesses, which attract visitors themselves, good accessibility by car and/or public transport can be decisive. “We offer our customers individual success driver analyses, in which we determine exactly which location factors are decisive for their particular business model,” Hollburg adds.

For delivery services — especially those with a fast delivery promise — it is important to combine the analyses with travel time calculations. This makes it possible to find out exactly what kind of people one would reach from a warehouse in 15 minutes by e-bike, for example.

By using conventional methods, retailers only understand half of a customer’s journey. With location data, they can see the full picture. “LI provides visibility into what is taking place outside of a retailer’s four walls, showing where customers go before and after visiting a store, where else they shop, how far they travel to reach a store, and so much more,” says Ariel Eck, Director of B2B Marketing, Foursquare.

Retailers can enrich their customer profiles with this information, combining location data with other datasets, such as transaction data and online behaviors, in order to power personalization at scale.

Retailers don’t have to rely only on hardware installed in stores, such as beacons or cameras, in order to understand consumer behaviors. As the use of mobile devices has become universal (with 84% of the world’s population now owning smartphones), the volume of data from mobile devices has skyrocketed (45% of consumers use their phones for in-store price comparisons, and 65% of consumers have retailer applications on their phones).

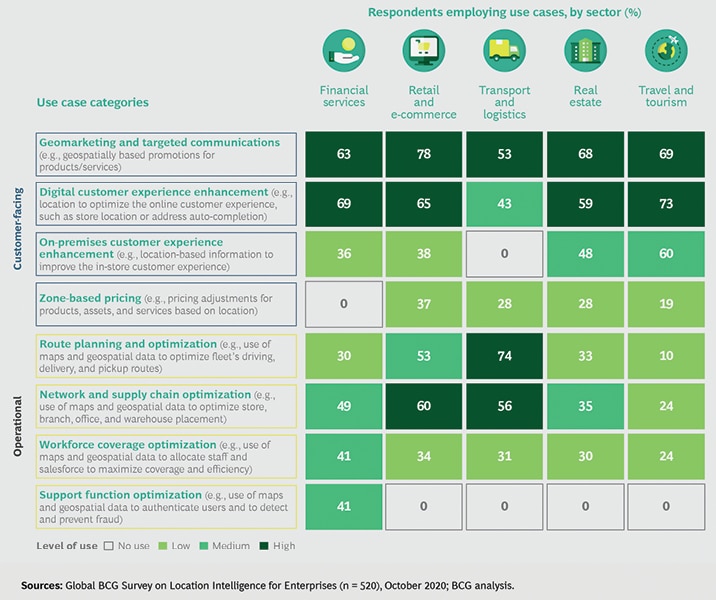

A survey conducted by a group of experts for BCG study in 2021, found that respondents use mapping and geospatial data across eight categories (See Figure 2).

“One type of mobile data in particular presents unprecedented opportunities for retailers — location data. Location data from mobile devices empowers retailers to answer key questions, uncover hidden insights, improve customer experiences, and achieve better business outcomes. In fact, 95% of executives say that geospatial data is important to getting business results today, and 92% say it will become ever more essential in the next three to five years, according to a recent BCG study,” says Eck.

Indoor Location Marketing report shows that the demand for real-time location services — indoor positioning — will only increase in the future, and will become a USD 19.7 billion industry by 2026.

“Customer records appended with location attribution can produce greater insights into targeting, acquisition, and retention and improve profitability. Analytics help to understand who your customers are in terms of location demographic profile and buying habits, behaviors and lifestyle, where one lives and shops, etc. Analytics also help evaluate whether you are targeting the right customers and the right locations in marketing activities,” says Andy Peloe, Product Management Director at Precisely.

Location data can help businesses make strategic decisions that improve margins. For example, location data helps organizations analyze footfall data, in combination with location and socio-economic information, to optimize the mix of physical and online locations or to identify new store locations and plan franchise territories.

“Location data helps balance physical and digital presence, helps better understand market opportunity and untapped potential, helps to improve customer experience through tailored marketing, and helps to uncover growth and operational efficiency opportunities,” points out Peloe.

There are numerous types of retail data that can add meaningful insights to a cycle of analysis and application. For location-based data, two of the most relevant types of data are collected about the store and about the customer.

“Store location data gets more granular, focusing on geospatial information, which may include neighborhood traffic, retail foot traffic, point of interest (POI) visitation data/store visit tracking, competitor visit tracking, and customer catchment areas,” says Thomas Walle, CEO and Co-founder, Unacast.

“Predict relevant KPIs such as sales or number of visitors. Our analytics have shown that with geo-referenced data, we can predict 80-90% of a branch’s success, be it a store, gym or restaurant. This is preceded by a deeper, AI-based analysis that identifies success drivers. However, as these analyses require an extensive data base, this is only possible for businesses with multiple branches,” adds Hollburg.

© Geospatial Media and Communications. All Rights Reserved.