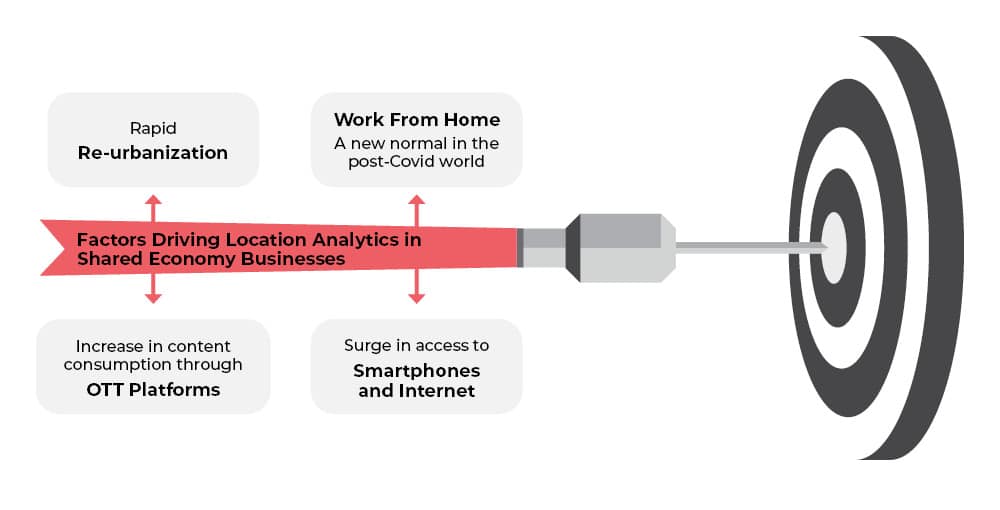

Rapid re-urbanization

As per “NY 2X”, a white paper published by Unacast, in January/February 2021, the population flow in New York grew by 9000 in comparison to January/February in 2019, while the income growth rate was up by around +233%. Therefore, the re-migration of people, post Covid, from suburban to urban areas is happening at a faster pace than expected. In general, even before the pandemic, the migration of people from suburban and rural to urban areas had led to a rise in population density, caused a scarcity of public resources, and increased carbon emissions as well as congestion on roads in metro cities. In the context of improving mobility in cities, Alain De Taeye, Board Member, TomTom, says, “We need to look at clean investments that are in line with improving the climate and solving climate problems. In times to come, this sector will shape up in a way that allows us to meet our ultimate goals of no congestion, no emissions, and no traffic collisions. This will become reality through innovations.” The growth in shared mobility businesses is directly linked to making roads safer and the environment cleaner. Using accurate maps, companies such as Grab, Ola, and Uber enable a reduction in road traffic, as well as ensure efficient use of fuel and vehicles.

Work-from-anywhere

The pandemic has led to people and organizations adopting new work routines that could be from anywhere in the world. A research paper titled “Why Working from Home Will Stick” concluded that 20% of the workdays are expected to be from home in the post-pandemic era. The work-from-home trend will continue to have a notable impact on last-mile delivery businesses working on a shared economy business model that is largely driven by location-based services.

Surge in access to smartphones, Internet

There has been a global surge in the use of smartphones. As per Statista, the total number of smartphone users reached around 6.05 billion in 2020 and is expected to grow to 7.52 billion by 2026. As per the “Digital in 2020” report by We Are Social Inc, the global penetration of the Internet was around 59% of the world population in January 2020, which, in comparison to January 2019 was an increase of around 7%. Further, an increase in high-speed Internet connectivity is making it easier to create digital opportunities, thereby shaping a positive environment for Internet-driven location-based shared economy businesses. “Access to the Internet by masses has brought us to a point where many important and complex things can be done seamlessly. This system relies on trust, which can be enabled through institutional development and strong and reliable processes. We see that reflecting in all applications these days,” adds Oliveira.

Increase in content consumption through OTT platforms

The masses continue to explore ways of consuming content. OTT platforms such as Netflix and Amazon Prime have witnessed a steep growth in usage over the years. As per Statista, the revenues of the OTT video market are expected to grow at a CAGR of 11.26% between 2021 and 2025. The increase in content consumption on OTT can be attributed to the investments made by these platforms in understanding user behavior based on user location. This has helped them keep visitors to their sites engaged by showcasing recommendations in real time. With increasing options for users to choose from, investments by OTT platform companies in enhancing capabilities that could enable them to process user preferences in real time and make data-driven decisions, are only going to increase. Post pandemic, the services which can be consumed within the comfort of one’s own home are experiencing a rise, and digital content consumption through OTT platforms is definitely amongst this set of services, leading to growth in shared economy business model in the entertainment sector.

“Location analytics has the potential to provide insights about the customer base, as well as opportunities, gaps, and a better understanding of the competition. If used correctly, it can also be the key to identifying challenges with the shared economy business model and be a leading indicator to stay ahead of these challenges, ” concludes Katz.